Conference Finances

Using the ACM In-House Bank Account

ACM provides use of an ACM in house bank account for each conference. The benefits of using this account include:

- Ease of Set up: Once revenue is received or an invoice is issued to the conference, the account is automatically set up. No action is required by conference leaders.

- Payments: ACM pays all invoices, and can issue payment in most currencies via check or wire transfer.

- Tracking: The income and expenses are logged on an online report called the CIP (Conference in Progress). Please request your Conference Operations Liaison to grant you CIP access. Conference accounts reconcile once a week.

- Closing: After the conference is over, ACM will prepare the final financial report and “close” the conference bank account following your review and approval.

Using a University Bank Account

Many conferences outside of the US still choose to utilize the ACM in house account but sometimes prefer to set up an account at a University, or with a bank. If the committee plans on doing this they should notify their Conference Operations Liaison as soon as possible so they can be provided with an Outside Bank Account Agreement document which requires committee signature.

The drawbacks of using an outside bank account include:

- Increases Committee Responsibilities: Committee is responsible for making all payments, tracking income and expenses, and providing ACM with accurate bank statements monthly. They also must collect all documentation for any grants, reimbursements or awards that are given out and send this to their Conference Operations Liaison. VAT requirements must also be monitored on all financial transactions.

- Closing: Committee is responsible for providing closing documents to ACM including a copy of the local banking closing statement confirming the account has been closed. The committee is also responsible for returning all surplus to ACM.

Can a conference use a bank account outside of ACM that is not at a University?

Bank accounts managed by a Conference Management company that has been contracted to provide services to the conference can be used as well. Personal bank accounts cannot be used.

Receiving Corporate Support Income

Many technical organizations view ACM conferences as an opportunity to reach out to a highly qualified technical audience. These organizations may choose to financially support/sponsor ACM events.

How does a conference request an invoice in order to receive corporate support funds?

When you have a sponsor who has agreed to make a contribution to the event, please notify your Conference Operations Liaison so they can set up a Conference Support Homepage for the event. The person on the committee handling sponsorship will receive a link and password to the page, as well as instructions on how to use it to invoice their sponsors.

**Please note it can take 24-48 business hours from the time the invoice is requested for our finance department to send it out.

How do the organizers find out when the funds are received?

Our online system allows the organizers to track their corporate support. The organizers will receive emails to notify them when the invoice has been issued to the company and another email when ACM receives the funds.

How long does it take corporate sponsors to pay the invoice?

It varies from sponsor to sponsor. Some sponsors send payment right away, while others take several months. If the support funds have not been received by ACM within 30 days of sending the invoice, it is a good idea for you to follow up with the point of contact to find out when payment can be expected. ACM can resend an invoice during this time if necessary. If an invoice needs to be resent, a request can be made through the conference support homepage.

What type of benefits are provided to corporate supporters?

It is up to the committee to provide their supporters with a list of benefits and/or list these benefits on the conference website. Standard benefits include acknowledgement on the conference website and in the program, supply giveaways or swag at the conference, complimentary registrations, or opportunities to sponsor specific conference events such as a reception/dinner at the conference.

What type of payments does ACM accept from these organizations?

ACM accepts payments via check, wire transfer, or credit card. Payment instructions are provided on the invoice ACM sends. If a donor would like to pay by credit card, they should contact the ACM Accounts Receivable Dept at 212-626-0596.

Receiving Exhibitor or Advertising Income

Many technical organizations view ACM conferences as an opportunity to showcase and demonstrate their new products and services to a highly qualified technical audience. These organizations may choose to exhibit at ACM events.

How does an organizer request an invoice for exhibitors or advertisers?

Please notify your Conference Operations Liaison so they can send you or someone from your committee a link to request these invoices. We will generate a link and password to the page, as well as instructions on how to use it to invoice your exhibitors and/or advertisers.

**Please note it can take 24-48 business hours from the time the invoice is requested for our finance department to send it out.

How do the organizers find out when the funds are received?

Our online system allows the organizers to track their exhibitor payments. The organizers will receive emails to notify them when the invoice has been issued to the company and another email when ACM receives the funds.

What type of payments does ACM ACM accept from these organizations?

ACM accepts payments via check, wire transfer, or credit card. Payment instructions are providedon the invoice ACM sends. If a supporter would like to pay by credit card, they should contact ACM Accounts Receivable at 212-626-0596.

Paying Conference Expenses with the ACM In-House Bank Account

A great benefit of using the in-house bank account is the ease of paying bills. All invoices can be sent directly to your Conference Operations Liaison who will process payment based Chair/Treasurer approval.

Invoices should be addressed to:

Association for Computing Machinery

1601 Broadway, 10th Fl.

New York, NY 10019

Attn: Your Conference Operations Liaison (with reference to the name of the conference)

-

ACM is unable to pay invoices that are invoiced to the organizers personally or to their employers or employer addresses.

-

Once an invoice is received your Conference Operations Liaison will request payment approval from the Conference Chair or Treasurer.

-

Please ask the vendor to provide their tax information at this link. Please notify your conference operations liaison once their tax info is provided.

Can ACM pay by credit card?

ACM prefers to issue funds via check but can make a credit card payment if necessary.

How do we make payments if there are not enough funds in our Cvent account?

Conference payments are made based on the approved budget, not on the actual funds the conference has accrued.

ACM Payment Policy

There is a three week timeframe to process check and wire payments. ACM cannot “rush” payments outside of this timeframe. This policy applies to all vendors, contracted services, hotels/venues, reimbursements, as well as any other miscellaneous payments. Alternatives arrangements with vendors must be made if checks are needed outside that timeframe. Please plan payments accordingly.

ACM W-8/W-9 Policy

ACM is required to collect W-8/W-9 forms from individuals who receive any of the following:

-

Cash payments, including, but not limited to check, ACH, Wire, directly from ACM

-

Monetary gifts or payments, such as gift cards, electronic gift cards, or cash equivalent vouchers, regardless of the dollar amount, and;

-

Non-monetary gifts, such as electronics, valued at $100 or more.

This requirement applies to individuals who receive any of the above items directly from ACM, an ACM employee, or an ACM volunteer, and the funding source of such payment is ACM.

For US residents, tax forms will be distributed to individuals if the amount received is above the IRS threshold. As of Calendar Year 2020, this threshold is $600 or more. For individuals outside the US, the applicable withholding and reporting requirements will be followed based on the specific country’s requirements.

Reimbursing Volunteer Leaders

Organizers may pay out of pocket for small expenses (a committee dinner or office supplies), and request reimbursement from ACM.

- ACM has a volunteer reimbursement form that leaders need to complete and submit along with their receipts to their Conference Operations Liaison. The expense report and receipts should be submitted as a single PDF rather than individual files. ACM accepts scanned copies of receipts, or originals via mail or courier if the person prefers.

- Receipts are required for all expenses over $25.

- ACM cannot accept order confirmations as proof of payment.

- Personal meal reimbursement is limited to $60 a day for conferences that take place in the US and $75 per day for conferences outside the US.

- Once a reimbursement request is received, your Conference Operations Liaison will request payment approval from the Conference Chair or Treasurer.

- US-based recipients are paid via direct deposit (or check if preferred).

- Recipients outside the US are paid via wire transfer.

- Once a volunteer submits a payment request, it can take up to 15 business days to receive payment.

- Receipts must to show that payment was made rather than indicate a balance due. A document showing proper receipt format can be found here.

- Per ACM travel policy, travel insurance, fees paid to travel agents, as well as frequent flyer miles are not reimbursable expenses.

- Requests for mileage reimbursement must include the to/from addresses, number of miles, and purpose of trip (a print mileage map with those details is acceptable as well). ACM reimburses according to the current IRS business mileage rates . IRS mileage rates change frequently, so it is recommended to check the web-site prior to requesting reimbursement

- Please note that timely payments are based on the accuracy of the information provided. ACM cannot release payments without the proper documentation and approvals as noted above.

Reimbursing Speaker Expenses

- For speaker travel reimbursements, ACM has an expense report that speakers must complete and submit along with their receipts to the Conference Operations Liaison. The expense report and receipts should be submitted as a single PDF rather than individual files. ACM accepts scanned copies of receipts or originals via mail or courier, if preferred.

- Receipts must show payment was made rather than indicate a balance due.

- Receipts are required for all expenses over $25.

- ACM cannot accept order confirmations as proof of payment.

- Personal meal reimbursement is limited to $60 per day for conferences that take place in the US, and $75 per day for conferences outside the US.

- Once a reimbursement request is received, your Conference Operations Liaison will request payment approval from the Conference Chair or Treasurer.

- US-based recipients are paid via direct deposit (or check if preferred).

- Recipients outside the US are paid via wire transfer.

- Once a speaker submits a payment request, it can take up to 15 business days to receive payment.

- Receipts need to show show that a payment was made, and not indicate a balance due.

- Per ACM travel policy, travel insurance, fees paid to travel agents, as well as frequent flyer miles are not reimbursable expenses.

- Requests for mileage reimbursement must include the to/from addresses, number of miles, and purpose of trip (a print mileage map with those details is acceptable as well). ACM reimburses according to the current IRS business mileage rates . IRS mileage rates change frequently, so it is recommended to check the web-site prior to requesting reimbursement

- Please note that timely payments are based on the accuracy of the information provided. ACM cannot release payments without the proper documentation and approvals as noted above.

Paying Speaker Honorariums or Conference Awards

- Each recipient completes an award form.

- If the committee is paying multiple individuals, it is best to provide your liaison with a spreadsheet in advance, with the approved amounts. This saves time with processing.

- Honorarium and award payments are subject to US IRS Miscellaneous Income Tax Reporting (Form 1099).

- ACM is required by law to withhold taxes for non-resident individuals outside the United States. As a result, ACM will withhold 30%. Grantees may qualify for reduced rates of US tax pursuant to treaties into which the United States has entered with their countries of residence. Grantees who feel that they qualify for this relief would be able to recoup the taxes ACM withholds by filing US federal tax returns. Grantees should consult with their own tax advisors to (i) determine whether they are eligible for such a treaty-based reduction in US tax, and (ii) obtain assistance in preparing a US federal tax return.

- Recipient must provide the appropriate tax information to ACM through our tax form collection page. For those receiving payment in the US, a W9 must be completed. For payments made outside the US, a W8 is required. Please notify your Conference Operations Liaison once the appropriate tax information is completed at the link.

- US-based recipients are paid via direct deposit (or check if preferred).

- Recipients outside the US are paid via wire transfer.

- Once a speaker submits a payment request, it can take up to 15 business days to receive payment.

- If the committee plans to present award checks at the conference, you must provide your Conference Operations Liaison with completed award requests (including social security/tax payer ID information) 30 days or more prior to the start of the conference. This allows for adequate processing and shipping time. For requests outside the 30 day timeframe, we suggest providing the recipient onsite with an envelope and letter indicating the payment will be sent to them directly.

Does the speaker need to submit their travel receipts to get their honorarium?

An honorarium is considered an award, not a reimbursement, therefore receipts are not necessary

Is it okay for a conference organizer to make a presentation and receive an honorarium?

ACM has guidelines in place regarding honorarium payments. To avoid the appearance of a conflict of interest, conference organizers should not expect to receive honoraria for their participation.

May an honorarium recipient donate their award?

Individuals who wish to donate their honorarium to a 501c3 organization are required to provide an email with the following information and documents:

- Donation Amount

- Banking Information for Wire Transfer

Along with the following documentation:

- Name of the Organization

- Tax ID of the Organization

- IRS Determination Letter

- W9 for the Organization

Or

- Copy for the most recent Form 990 (not more than 15 months old)

Paying Student Travel Grants

ACM has an online system in place to process travel grants. Contact your Conference Operations Liaison when the committee is ready to distribute student travel grants. The conference will then be provided with a student travel grant homepage, an online form where the leader will enter a list of recipients, including their email addresses and amount awarded to them. These recipients will receive an email notification that includes a link to a personal online expense form for them to complete. The form includes the instructions where to submit the form and receipts. It is advised that the committee tell the students in advance to save all their travel receipts.

- ACM does not reimburse visa fees and related expenses, nor does it cover rental cars and related expenses.

- If your travel grant allows for flight expenses, this expense is reimbursable only when traveling round trip from your residence to and from the conference location.

- US-based recipients are paid via direct deposit (or check if preferred).

- Recipients outside the US are paid via wire transfer.

- Please let your Conference Operations Liaison know if the grants will be paid by the SIG or the conferences, so the appropriate link is issued.

- When allocating travel funds, please be aware that due to US sanctions it can be difficult for ACM to send funds to certain countries. Please consult the list of sanctioned countries on the US Treasury website for further information. If you have any questions about payments made to these countries, please contact your ACM program coordinator for further information.

Can the students request reimbursement from ACM prior to the conference?

ACM policy requires travel be completed before reimbursement can be requested. This guarantees that only students who attend the conference will be reimbursed.

How long does it take for ACM to send payment?

Students should allow up to 30 days from the time of mailing in their receipts to receive a check. They will receive an email notification when ACM has processed their receipts.

Does ACM pay out grants from sponsorship received from the National Science Foundation?

The National Science Foundation has strict guidelines regarding the distribution of their grant money. Please inform your Conference Operations Liaison if the conference is expecting funds from NSF and they will provide further guidance regarding the procedure.

If a conference has a surplus, can it be used to pay additional student travel grants?

All travel grant expenses should follow the expectations included in the original approved budget.

Is registration a reimbursable travel expense?

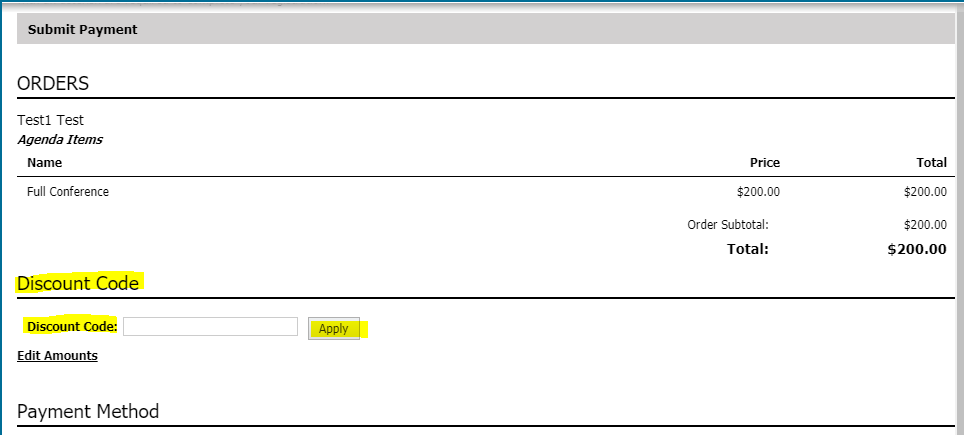

When volunteer leadership decides to reimburse registration, a comp code/discount code should be provided.

There are 2 ways to do this:

- If the SIG is supporting the travel grants, funds are transferred to the conference budget to cover the comps. Please contact your Conference Operations Liaison to make the transfer.

- If the conference is supporting the travel grants, the funds to cover the comps should be included in the approved conference budget.

Using comp/discount codes allows students to register without having to pay upfront, send in receipts, provide banking info, wait for reimbursement, or pay any fees their bank may assess them. The ACM registration vendor, Cvent, has detailed information on their website on how to create discount codes. When the student registers, they will simply enter the code on the Cvent payment page as shown below:

If you are using a vendor that is not Cvent, you will need to check with them for guidance on using codes.

Procedure for Closing Conference Finances

Finalizing the conference finances is an important part of being a Conference Chair. ACM’s closing procedure requires conference accounts to close within 120 days following the event. Your conference operations liaison will send you information with regard to closing the conference books beginning 4 weeks prior to the event. All payment requests must be submitted to your Conference Operations Liaison within 30 days post-conference. Post-conferences finances may include:

- Committee travel/purchase reimbursement requests

- Outstanding and final vendor invoices

- Speaker travel/honorarium payment requests

- Student Travel Reimbursements. *The committee should enter the recipient information into ACM’s CMS database at least four weeks pre-conference so the students receive the instructions and can submit promptly after attending the event.

- Follow up on any outstanding corporate support payments

Who completes the final report?

- For conferences that use ACM in-house banking, the final report will be completed by ACM HQ.

- For conferences that use university banking, the final report will be completed by the committee

- If the conference held an outside bank account as well as an in house account, the committee is only required to complete the report for the outside bank account. ACM will reconcile the report with the in house bank account for one final report.

What documentation does the committee need to provide for conferences using a university bank account?

- Copy of the local accounts bank statement

- Backup proofs (receipts) of all income and expenses processed through the local account

- Completing the local account section of the final report

- Name, address and amount contributed for all contributors, if any

- Name, address, tax identification, and amount paid for all recipients of grants, awards, and honorariums, if any

- Attendee registration list

What happens if the committee needs more than 120 days to make or receive payments?

This should not be an issue as four months is adequate time to finalize the financials. Any payments that need to be made after the conference closes will be billed to the sponsoring SIGs.

Our budget included VAT, how is that indicated in the closing report?

The registration revenue in the closing is VAT-exclusive because VAT is not revenue but taxes paid to the government. Expenses paid are VAT-inclusive if they are subject to VAT, and if we recover the VAT on expenses, there will be a credit on the financial expense to indicate the recovery. However, the process of VAT return is complicated and time consuming. In the case where the conference can be closed but the VAT return is still not complete, we will work with our finance department to include an estimate amount of recovery in the closing. When the actual recovery is received, then the financials will be adjusted accordingly.

Our conference had a good surplus. Can we credit some of it to next year’s event?

Conference surplus does not carry over from year to year. When the conference finances close, all funds are returned to the sponsoring SIGs.

If your conference is based in a US state where ACM has tax-exmept status, please contact your Conference Operations Liasion for a copy of the tax exempt certificate required by vendors to remove the tax.

Policy for Services Performed by Volunteer Leaders

- ACM conferences are run by volunteer leaders. The ACM Conflict of Interest Policy prevents the organization from compensating a volunteer for their leadership and participation in a conference. This includes requests for payment of honorariums.

- ACM can reimburse budgeted travel for committee members. If the committee plans to reimburse, please include committee travel as an expense in your conference budget. Also be sure to obtain copies of all receipts. These will need to be submitted to ACM when requesting reimbursement.

- If the conference would like to cover committee conference registration fees, the registration chair should arrange for a complimentary registration code through the chosen registration system. ACM policy prevents registration fee reimbursement post conference

- Rewarding committee members for their hard work with a plaque, certificate or modest gift not exceeding ~$50 USD is acceptable. Gifts in the form of cash (gift certificates) are not permitted.

Can conference leaders participate in awards programs at hotels that provide points?

It is against ACM policy for volunteer leaders to collect points or awards for any hotel expenditures that are paid for by ACM.

Equipment Purchases

What if the conference needs to purchase a printer for registration or other equipment? Can ACM do this and ship it to the conference?

ACM does not make equipment purchases on behalf of conferences. Any purchased made by the committee must be reported to ACM, as they are considered assets. Equipment purchases should be included in the conference budget.

Please complete an equipment purchase form and return it to your Conference Operations Liaison. The following information is required:

- Date of purchase

- Description of equipment purchased (including any model or serial #)

- Name of the committee member responsible for managing the purchase, as well as their contact information.

- Note what will happen to the equipment after the conference.

- Include a copy of the purchase receipt

Equipment should not be donated or disposed of following the conference without approval from ACM.

Helpful Financial Forms

- Reimbursement Form

- Samples of Proper Receipt Format

- Direct Deposit Instructions

- Award Form

- Final Financial Report Form for Outside Banking

- ACM Bank Details (for ACM to receive funds on behalf of the conference)

- ACM Tax Form Collection (submit a W9 or W-8BEN)

- Equipment Purchase Form